| | Published January 24th, 2018

| The Real Estate Year in Review

| | 2017 home sales in Lamorinda | | By Conrad Bassett |  | | |

It was another extremely strong year for sellers of residential real estate in Lamorinda; sales volume in 2017 rebounded as supply increased but that was matched by continued strong demand and average prices went up in Lafayette, Moraga and Orinda.

Homes stayed on the market for a similar limited time like in 2016 and the majority of homes sold at or above their asking price.

Homes stayed on the market for a similar limited time like in 2016 and the majority of homes sold at or above their asking price.

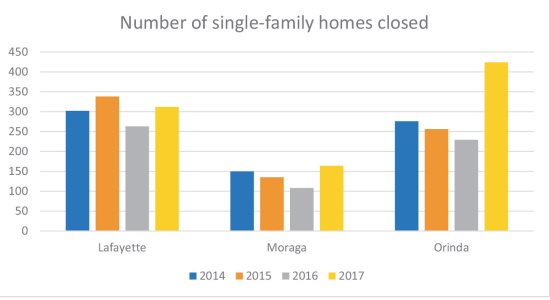

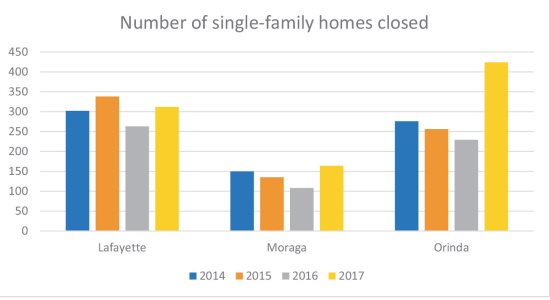

Per Contra Costa Association of Realtors statistics reported for closings January 1 through December 31, 2017, 312 single family homes closed in Lafayette versus 263 in 2016. There were 338 in 2015 and 302 in 2014. For the 312 reported closings, sales prices ranged from $740,000 to $6.5 million and the average time on market was 23 days, a slight decrease from the 28 days in 2016. The average sale price was $1,625,636 up from $1,506,811 in 2016. In 2015 it was $1,531,605, $1,339,303 in 2014, $1,248,532 in 2013, $1,042,921 in 2012 and $1,040,014 in 2011. The average sales price was 102.2 percent of the final list price. There were no Lafayette short sales or foreclosures sold on the MLS.

Per Contra Costa Association of Realtors statistics reported for closings January 1 through December 31, 2017, 312 single family homes closed in Lafayette versus 263 in 2016. There were 338 in 2015 and 302 in 2014. For the 312 reported closings, sales prices ranged from $740,000 to $6.5 million and the average time on market was 23 days, a slight decrease from the 28 days in 2016. The average sale price was $1,625,636 up from $1,506,811 in 2016. In 2015 it was $1,531,605, $1,339,303 in 2014, $1,248,532 in 2013, $1,042,921 in 2012 and $1,040,014 in 2011. The average sales price was 102.2 percent of the final list price. There were no Lafayette short sales or foreclosures sold on the MLS.

In Moraga there were 164 single family closings which was a huge increase from 108 in 2016 and 135 in 2015. There were 150 in 2014. Prices ranged from $725,000 to $2.75 million. The average sale price was $1,388,287. This was a solid rise from the $1,272,179 in 2016. The 2015 average was $1,290,804, $1,205,576 in 2014 and $1,147,207 in 2013. In 2012, it was $991,469 and in 2011 it was $894,768. The number of days on market in 2017 was 28 - about the same as 26 in 2016. The average home sold for 100.9 percent of its last list price. There was one REO property that closed on the MLS and no short sales.

In Moraga there were 164 single family closings which was a huge increase from 108 in 2016 and 135 in 2015. There were 150 in 2014. Prices ranged from $725,000 to $2.75 million. The average sale price was $1,388,287. This was a solid rise from the $1,272,179 in 2016. The 2015 average was $1,290,804, $1,205,576 in 2014 and $1,147,207 in 2013. In 2012, it was $991,469 and in 2011 it was $894,768. The number of days on market in 2017 was 28 - about the same as 26 in 2016. The average home sold for 100.9 percent of its last list price. There was one REO property that closed on the MLS and no short sales.

In Orinda the number of single-family closings was at 242 - up slightly from 229 a year ago but down from 256 in 2015 and 276 in 2014. The reported sales ranged in price from $650,000 to $3.9 million with an average price of $1,614,279. In 2016 it was $1,577,727. In 2015 it was $1,481,443 and in 2014 it was $1,370,088. In 2013 it was $1,240,158 and in 2012 it was $1,068,303. The average was $1,021,751 in 2011. The average market time was 24 days, about the same as a year ago when it was 23. The average sales price was an average of just over 102 percent the final list price for the reported sales. There were no short sales or REO (bank owned) sales in Orinda in 2016 or 2017.

In Orinda the number of single-family closings was at 242 - up slightly from 229 a year ago but down from 256 in 2015 and 276 in 2014. The reported sales ranged in price from $650,000 to $3.9 million with an average price of $1,614,279. In 2016 it was $1,577,727. In 2015 it was $1,481,443 and in 2014 it was $1,370,088. In 2013 it was $1,240,158 and in 2012 it was $1,068,303. The average was $1,021,751 in 2011. The average market time was 24 days, about the same as a year ago when it was 23. The average sales price was an average of just over 102 percent the final list price for the reported sales. There were no short sales or REO (bank owned) sales in Orinda in 2016 or 2017.

There were no reported sales in the MLS in Canyon in 2017.

There were no reported sales in the MLS in Canyon in 2017.

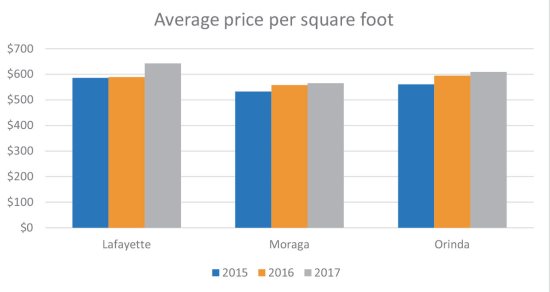

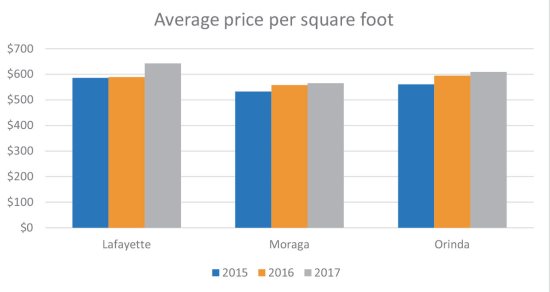

On an average price per square foot basis for reported sales in 2017, Lafayette homes sold for $642.46 up solidly from 2016 when it was $589.47. In 2015 it was $585.87 and an increase from 2014 when it was $546.87. In 2017, Moraga homes sold for $565.37, a slight increase from $558.02 per square foot in 2016, and $532.90 in 2015. In Orinda last year it was $609.13, also a little rise from $594.37 in 2016 and $560.79 in 2015 and continuing the trend that started in 2012. It was $520.77 in 2014 and $489.85 in 2013 and $422.68 in 2012.

On an average price per square foot basis for reported sales in 2017, Lafayette homes sold for $642.46 up solidly from 2016 when it was $589.47. In 2015 it was $585.87 and an increase from 2014 when it was $546.87. In 2017, Moraga homes sold for $565.37, a slight increase from $558.02 per square foot in 2016, and $532.90 in 2015. In Orinda last year it was $609.13, also a little rise from $594.37 in 2016 and $560.79 in 2015 and continuing the trend that started in 2012. It was $520.77 in 2014 and $489.85 in 2013 and $422.68 in 2012.

In the condominium/town home category, Lafayette had 30 closings in 2017, a big increase from the 16 closings in both 2016 and in 2015. As new developments of condominiums and townhomes are being added in Lafayette, some new construction sales will not go through the MLS.

In the condominium/town home category, Lafayette had 30 closings in 2017, a big increase from the 16 closings in both 2016 and in 2015. As new developments of condominiums and townhomes are being added in Lafayette, some new construction sales will not go through the MLS.

The actual sales if all of the new homes are included would increase the total. Prices ranged in 2017 from $525,000 to $1,239,000. Moraga had 65 closed units down again last year from the 79 closed units in 2016 and 81 in 2015. Sales ranged from $350,000 to $1,195,000. This includes attached homes in Moraga Country Club. Orinda had eight closings while they had four in 2016. They sold from $425,000 for a one-bedroom on Brookwood to $1.48 million in Orindawoods.

The actual sales if all of the new homes are included would increase the total. Prices ranged in 2017 from $525,000 to $1,239,000. Moraga had 65 closed units down again last year from the 79 closed units in 2016 and 81 in 2015. Sales ranged from $350,000 to $1,195,000. This includes attached homes in Moraga Country Club. Orinda had eight closings while they had four in 2016. They sold from $425,000 for a one-bedroom on Brookwood to $1.48 million in Orindawoods.

It should always be noted that there are also a few direct sales that do not go through the MLS and they are not reported here. These may include some foreclosures that were sold at the courthouse as well as some sales between private individuals.

It should always be noted that there are also a few direct sales that do not go through the MLS and they are not reported here. These may include some foreclosures that were sold at the courthouse as well as some sales between private individuals.

As of Jan. 10, there were 33 dwellings under contract per the MLS in the three communities combined, with asking prices of $514,500 to $4.495 million. It should be pointed out that there is one "Potential Short Sale" that is currently pending and no REOs. Prices have continued to rise over the last few years and more owners now have equity in their homes and have not had to go the short-sale process or faced foreclosures.

As of Jan. 10, there were 33 dwellings under contract per the MLS in the three communities combined, with asking prices of $514,500 to $4.495 million. It should be pointed out that there is one "Potential Short Sale" that is currently pending and no REOs. Prices have continued to rise over the last few years and more owners now have equity in their homes and have not had to go the short-sale process or faced foreclosures.

A comparison of year-end inventory in the three communities combined shows 40 homes on the market. Last January there were 45 homes on the market. Typically the biggest inventory is in the spring and early summer, however this current number may point to another year with a combination of qualified buyers vying for a continued limited supply. The current asking prices range from $661,285 to $1.65 million in the three communities combined.

A comparison of year-end inventory in the three communities combined shows 40 homes on the market. Last January there were 45 homes on the market. Typically the biggest inventory is in the spring and early summer, however this current number may point to another year with a combination of qualified buyers vying for a continued limited supply. The current asking prices range from $661,285 to $1.65 million in the three communities combined.

In Lamorinda in 2017, 115 homes sold for more than $2 million. In 2016, 82 homes sold for more than $2 million.

In Lamorinda in 2017, 115 homes sold for more than $2 million. In 2016, 82 homes sold for more than $2 million.

Interest rates have remained historically low although there has been some increase the last several weeks but they are still very attractive to those with down payments of at least 20 percent. Corporations continue to expand and contract and also to relocate families. The minimal amount of single family new construction has helped keep supply and demand within a better balance than a lot of other neighboring communities. The East Bay and closer to San Francisco communities like Lafayette, Moraga and Orinda as well as Piedmont and several neighborhoods in Oakland and Berkeley continue to benefit from their proximity to San Francisco where prices remain very high. The East Bay is a "bargain."

Interest rates have remained historically low although there has been some increase the last several weeks but they are still very attractive to those with down payments of at least 20 percent. Corporations continue to expand and contract and also to relocate families. The minimal amount of single family new construction has helped keep supply and demand within a better balance than a lot of other neighboring communities. The East Bay and closer to San Francisco communities like Lafayette, Moraga and Orinda as well as Piedmont and several neighborhoods in Oakland and Berkeley continue to benefit from their proximity to San Francisco where prices remain very high. The East Bay is a "bargain."

The new tax laws changing the amounts that can be deducted may affect the higher end market but this has yet to be seen. The trend that began in 2011 continues today where in many situations in the three communities the seller receives multiple offers and homes sell for above the list price. This, when coupled with an extremely low supply and a willingness by sellers to be realistic in their pricing should continue to fuel a strong market in 2018.

The new tax laws changing the amounts that can be deducted may affect the higher end market but this has yet to be seen. The trend that began in 2011 continues today where in many situations in the three communities the seller receives multiple offers and homes sell for above the list price. This, when coupled with an extremely low supply and a willingness by sellers to be realistic in their pricing should continue to fuel a strong market in 2018.

|

| | |  | | | | | | | | | | | |