| | Published November 26th, 2008

| Enhancing Orinda's Revenue-Where the Fire District and the Roads Collide

| | By Andrea A. Firth |  | |

Orinda has a $120 million problem-the roads and the failing infrastructure that surrounds them. Tough times yield tough choices. Does fixing Orinda's roads supercede maintaining the Moraga-Orinda Fire District (MOFD) at its current level? This is one of the many questions Orinda grapples with as it tries to find ways to shore up its failing infrastructure.

At two well-attended forums held in the past two weeks, Orinda's Revenue Enhancement Task Force presented their proposal for generating revenue to fund the significant infrastructure challenges that face the City. In a Power Point presentation including tables, pie charts, bar graphs, and bulleted lists, the Task Force carefully laid out their plan.

At two well-attended forums held in the past two weeks, Orinda's Revenue Enhancement Task Force presented their proposal for generating revenue to fund the significant infrastructure challenges that face the City. In a Power Point presentation including tables, pie charts, bar graphs, and bulleted lists, the Task Force carefully laid out their plan.

Of the nine key revenue sources identified by the Task Force, a reallocation of the property tax dollars designated for the Moraga-Orinda Fire District will generate the largest piece of the proposed fix. This property tax reallocation has also raised the most controversy of the revenue sources proposed.

Of the nine key revenue sources identified by the Task Force, a reallocation of the property tax dollars designated for the Moraga-Orinda Fire District will generate the largest piece of the proposed fix. This property tax reallocation has also raised the most controversy of the revenue sources proposed.

The Problem. After two road bond measures narrowly failed passage, Orinda's City Council has been faced with finding an alternative way of funding the City's significant infrastructure needs. The Task Force projects that the City will need a total of $120 million over the next 12 years for improvements to the roads ($80M), storm drains ($12M), and water pipes ($28M), Orinda's roads have been labeled the worst in the East Bay; inadequately maintained storm drains are a key contributor to the deterioration of the roads; and water pipes have been found to be undersized with insufficient flow to adequately address fire protection needs.

The Problem. After two road bond measures narrowly failed passage, Orinda's City Council has been faced with finding an alternative way of funding the City's significant infrastructure needs. The Task Force projects that the City will need a total of $120 million over the next 12 years for improvements to the roads ($80M), storm drains ($12M), and water pipes ($28M), Orinda's roads have been labeled the worst in the East Bay; inadequately maintained storm drains are a key contributor to the deterioration of the roads; and water pipes have been found to be undersized with insufficient flow to adequately address fire protection needs.

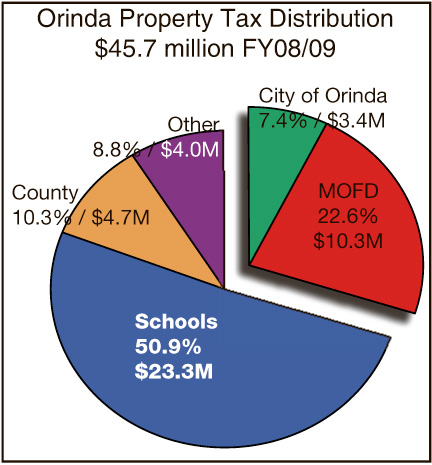

Property Tax Reallocation. The Task Force identified the City's and MOFD's shares of the property tax distribution as potential sources of revenue (see figure). Of the $45.7 million in property tax revenue to be generated in Orinda in 2008-09, the City's share of pie is estimated at $3.4M (7.4%) and MOFD's share is $10.3M (22.6%). Tax dollars allocated to the schools, the County, and other agencies were determined to be not viable sources.

Property Tax Reallocation. The Task Force identified the City's and MOFD's shares of the property tax distribution as potential sources of revenue (see figure). Of the $45.7 million in property tax revenue to be generated in Orinda in 2008-09, the City's share of pie is estimated at $3.4M (7.4%) and MOFD's share is $10.3M (22.6%). Tax dollars allocated to the schools, the County, and other agencies were determined to be not viable sources.

Based on the assumption that property tax revenue will grow at a rate of 7.5% over the next 12 years with the addition of the Wilder and Pulte developments and the increased assessed value of homes that are sold, the Task Force proposed to cap tax revenue to the City and MOFD at 4.5% and apply the remaining property tax dollars to infrastructure needs. "We can continue to grow at a rate of 7% despite what is going on in the current economy," explained Task Force member Michael Hanneken."

Based on the assumption that property tax revenue will grow at a rate of 7.5% over the next 12 years with the addition of the Wilder and Pulte developments and the increased assessed value of homes that are sold, the Task Force proposed to cap tax revenue to the City and MOFD at 4.5% and apply the remaining property tax dollars to infrastructure needs. "We can continue to grow at a rate of 7% despite what is going on in the current economy," explained Task Force member Michael Hanneken."

The Task Force felt that the City and MOFD could budget within the 4.5% cap based on an estimated inflation rate of 3%. Task Force member Allan Resnick added that budgeting within the cap would not be easy, but it could be done.

The Task Force felt that the City and MOFD could budget within the 4.5% cap based on an estimated inflation rate of 3%. Task Force member Allan Resnick added that budgeting within the cap would not be easy, but it could be done.

With these assumptions, the reallocation of tax revenue would redirect $16M from the City's piece of the pie over the next 12 years and $50M from MOFD's share.

With these assumptions, the reallocation of tax revenue would redirect $16M from the City's piece of the pie over the next 12 years and $50M from MOFD's share.

Other Revenue Sources. In addition to the tax reallocation, the Task Force proposed some accelerated funding measures including securitizing the gas tax revenue, drawing down the city reserves, and a tax revenue package-a bond measure estimated at about $25M-$30M, about half the amount of the previously proposed bonds.

Other Revenue Sources. In addition to the tax reallocation, the Task Force proposed some accelerated funding measures including securitizing the gas tax revenue, drawing down the city reserves, and a tax revenue package-a bond measure estimated at about $25M-$30M, about half the amount of the previously proposed bonds.

Fair Share. The Task Force also took the opportunity to re-evaluate the percentage share of property tax revenue that Orinda contributes to the MOFD as compared to Moraga's contribution. According to the Task Force, when the MOFD was formed in 1997, Orinda contributed 62% to Moraga's 38%. Because Orinda's assessed property values have increased more rapidly than Moraga's, the City now contributes 65%. The Task Force projects that Orinda's share will continue to rise, and they feel that the increasing share is not justified. They propose that Orinda's "fair share" of the MOFD cost be set at 60% and Moraga's at 40% based on the fact that Orinda has three fire stations to Moraga's two.

Fair Share. The Task Force also took the opportunity to re-evaluate the percentage share of property tax revenue that Orinda contributes to the MOFD as compared to Moraga's contribution. According to the Task Force, when the MOFD was formed in 1997, Orinda contributed 62% to Moraga's 38%. Because Orinda's assessed property values have increased more rapidly than Moraga's, the City now contributes 65%. The Task Force projects that Orinda's share will continue to rise, and they feel that the increasing share is not justified. They propose that Orinda's "fair share" of the MOFD cost be set at 60% and Moraga's at 40% based on the fact that Orinda has three fire stations to Moraga's two.

MOFD Responds. At the November 18th City Council meeting, MOFD Board President Fred Weil calmly, deliberately, and at length responded to the Task Force presentation on behalf of the Fire District. "In our view the proposal is flawed, incomplete, and based on incorrect assumptions," stated Weil. He noted that the projections for the income and expenses of the MOFD were outdated and did not include potential liabilities associated with medical, pension, and equipment costs.

MOFD Responds. At the November 18th City Council meeting, MOFD Board President Fred Weil calmly, deliberately, and at length responded to the Task Force presentation on behalf of the Fire District. "In our view the proposal is flawed, incomplete, and based on incorrect assumptions," stated Weil. He noted that the projections for the income and expenses of the MOFD were outdated and did not include potential liabilities associated with medical, pension, and equipment costs.

Weil added that the District would be irresponsible to accept a 4.5% revenue cap when the County pension fund assets have dropped dramatically in recent months, noting that the District would be faced with making up that deficiency with higher contributions. Weil also challenged the proposal to revise the Orinda and Moraga contributions stating that at least 65% of the Fire District resources are dedicated to Orinda. Weil questioned the Task Force's ability to prioritize the MOFD's needs and concluded, "The proposal of the task Force is one that the Board will not support."

Weil added that the District would be irresponsible to accept a 4.5% revenue cap when the County pension fund assets have dropped dramatically in recent months, noting that the District would be faced with making up that deficiency with higher contributions. Weil also challenged the proposal to revise the Orinda and Moraga contributions stating that at least 65% of the Fire District resources are dedicated to Orinda. Weil questioned the Task Force's ability to prioritize the MOFD's needs and concluded, "The proposal of the task Force is one that the Board will not support."

What Next? Despite the spirited discourse from both sides of the issue, Vice Mayor Sue Severson pressed forward asking Weil if the MOFD would be open to an independent evaluation of the proposal and review of MOFD operations. Weil cautiously indicated that the District would be open to talking about some things but expressed disappointment that the District's earlier communications about the inaccuracy of the assumptions had not been heeded. The Task Force also suggested the formation of an action committee to begin formal discussion with the Fire District and Moraga along with a continuation of the public dialogue and confirmation of the legal process for obtaining the tax allocation adjustment.

What Next? Despite the spirited discourse from both sides of the issue, Vice Mayor Sue Severson pressed forward asking Weil if the MOFD would be open to an independent evaluation of the proposal and review of MOFD operations. Weil cautiously indicated that the District would be open to talking about some things but expressed disappointment that the District's earlier communications about the inaccuracy of the assumptions had not been heeded. The Task Force also suggested the formation of an action committee to begin formal discussion with the Fire District and Moraga along with a continuation of the public dialogue and confirmation of the legal process for obtaining the tax allocation adjustment.

Missing from the discussion at both public meetings was the "M" of the MOFD-Moraga. At the time of this publication, members of the Moraga Town Council were unavailable for comment.

Missing from the discussion at both public meetings was the "M" of the MOFD-Moraga. At the time of this publication, members of the Moraga Town Council were unavailable for comment.

|

| |

| | | |