| ||||||

As stated, the White Paper holds vital information and warrants close reading by the town's members with stake in the game: Moraga residents, workers, employers, business owners, commercial and residential property owners, town government officials, and others. For purposes of this article, the lens widens to draw out a few of the comparisons the report makes between Moraga and its two neighboring Lamorinda cities. The information the White Paper's data and narrative highlight when noting the important contrasts and similarities throughout the region can be extrapolated and used beyond the town's geographic borders.

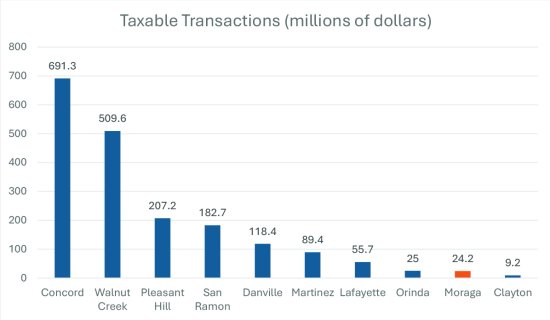

Beginning with sales tax revenues per capita, the report shows the decline in the last seven years is common to Moraga, Lafayette, and Orinda. The report breaks down sales tax revenues in Moraga and shows that relative to Lafayette and Orinda, Moraga receives much less of its sales tax from food and beverage stores and restaurants, and more from clothing/accessories and gasoline stations.

Moraga gathered data from Environics Analytics pertaining to "retail leakage" based on modeling consumer behavior and estimating the gap between retail supply and demand in given marketplaces. Comparisons showed all three communities could conceivably support more retail activity and are "leaking" retail spending to other cities. In Lamorinda, Orinda is capturing the smallest share of local spending (26%), followed by Moraga (33%) and Lafayette (45%). In terms of volume, the greatest leakage gaps are in motor vehicle and parts dealers, food and beverage stores, general merchandise, and food service and drinking places. The data is most useful in revealing sectors where expansion would mirror locational needs of businesses in that town or city and logically, might indicate the most successful ventures.

Another category, median household income in 2022, establishes Moraga at $193,707, Lafayette higher at $219,250 and Orinda rising to the top position at over $250,000. "Collectively, the three cities have roughly 60,000 residents and form one of the East Bay's Area's most affluent sub-markets," the report states. About the cost of residential property, it says, "Home prices in Moraga are among the highest in Contra Costa County, though they lag Orinda and Lafayette slightly. Zillow reports the average sales price in 2023 was $1,696,000 in Moraga, $1,843,710 in Lafayette, and $1,936,485 in Orinda. All of these figures are more than twice the countywide average of $793,190."

The White Paper has an extensive examination of commercial property profiles and emphasizes the necessity of a town or city to support investors, developers, owners and tenants with issues such as financing, permitting, dealing with aging infrastructure, establishing utility connections, and more. Placemaking and storytelling enter the picture upon inviting residents to offer input on the priorities unique to the community. Because Moraga is geographically more isolated than Lafayette and Orinda and is not on the BART line, for example, certain services are more or less in demand. With their more direct access, Lamorinda's two cities might consider commercial development projects with specific appeal centered on a different demographic baseline than Moraga planners utilize.

The report ends with outlines for five goals and specific policies aimed at raising the economic vitality of Moraga. Again, the items stand as strong recommendations for any community aspiring to improve and stabilize its economic base in 2024 and beyond. The five goals are for Moraga, but adding "Lafayette" and "Orinda" to each phrase could form a blueprint for the entire Lamorinda community:

1. Maintain a business-friendly environment that supports investment in Moraga.

2. Attract new businesses that meet the needs of Moraga residents and enhance the town's character.

3. Strengthen Moraga's identity as a college town. (Lafayette and Orinda could use their city's prominent feature and identity as a substitute for Moraga's Saint Mary's College-based designation.)

4. Modernize Moraga's two commercial districts so that they become more vibrant town centers and gathering places.

5. Promote Moraga's fiscal stability and capacity to provide essential services and infrastructure.

To read the full report, visit www.moraga.ca.us/DocumentCenter/View/8655/FINAL-PACKET---3-A---ECON-VITALITY-STUDY-SESSION

Reach the reporter at: