| | Published February 15th, 2012

| Orinda, the Malibu of the Bay Area Pollsters say residents rate quality of life high; remain concerned about roads and infrastructure

| | Laurie Snyder |  | | http://orinda.waterware.com/docushare/dsweb/Get/Document-4383/2012%20Poll%20Results%20Council%20Presentation.pdf Lamorinda Weekly also reported in our last issue about sales tax revenue, go to: http://www.lamorindaweekly.com/archive/issue0524/Local-Sales-Tax.html |

The Orinda City Council reviewed the results February 7 of the latest poll of residents regarding Orinda's quality of life, and in particular, their interest in paying for road and infrastructure repair.

The poll was conducted from January 22 to 25 with 402 Orindans "likely to vote in the November 2012 election," including a subset also likely to vote in June. David Metz, a Partner with FM3, presented the findings.

The poll was conducted from January 22 to 25 with 402 Orindans "likely to vote in the November 2012 election," including a subset also likely to vote in June. David Metz, a Partner with FM3, presented the findings.

The margin of sample error is plus or minus 4.9 percent.

The margin of sample error is plus or minus 4.9 percent.

Quality of Life, Safety, and Infrastructure

Quality of Life, Safety, and Infrastructure

Ninety-eight percent of participants rated Orinda's quality of life as excellent or good (65 percent labeling it excellent). Calling the results "an absolutely astonishing number," Metz said that, of every other FM3 poll, only Malibu and one other community received such high ratings.

Ninety-eight percent of participants rated Orinda's quality of life as excellent or good (65 percent labeling it excellent). Calling the results "an absolutely astonishing number," Metz said that, of every other FM3 poll, only Malibu and one other community received such high ratings.

Traffic was not seen as a serious problem, but road and storm drain conditions were. A combined 71 percent felt that fixing public streets and repairing potholes was extremely or very important (with 53 percent labeling it very important) while 76 percent prioritized the repair of collapsing storm drains (59 percent saying very important).

Traffic was not seen as a serious problem, but road and storm drain conditions were. A combined 71 percent felt that fixing public streets and repairing potholes was extremely or very important (with 53 percent labeling it very important) while 76 percent prioritized the repair of collapsing storm drains (59 percent saying very important).

And, while Metz observed reduced support for "driver, pedestrian and bicyclist safety" improvements, support for collapsing storm drain repairs rose, from 62 percent in 2006, to 76 percent in 2012.

And, while Metz observed reduced support for "driver, pedestrian and bicyclist safety" improvements, support for collapsing storm drain repairs rose, from 62 percent in 2006, to 76 percent in 2012.

Appetite for a Ballot Initiative

Appetite for a Ballot Initiative

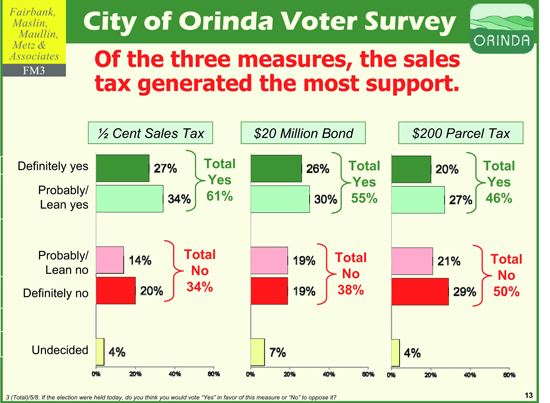

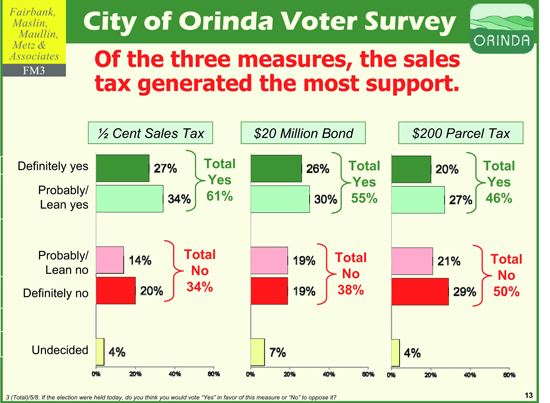

Funding mechanisms considered by those polled were: "A one-half cent sales tax funding general City services" (street and road repairs emphasized), street and road repair bond measures (10, 20, 60 million dollar), and a "$200 annual parcel tax funding street and road repairs."

Funding mechanisms considered by those polled were: "A one-half cent sales tax funding general City services" (street and road repairs emphasized), street and road repair bond measures (10, 20, 60 million dollar), and a "$200 annual parcel tax funding street and road repairs."

Passage of the sales tax increase would require approval by only a simple voter majority. A bond or parcel tax would require passage by a two-thirds majority.

Passage of the sales tax increase would require approval by only a simple voter majority. A bond or parcel tax would require passage by a two-thirds majority.

Projected sales tax supporters included: "Definitely yes," (27 percent), "Probably yes" (30 percent), and four percent undecided or leaning toward yes. Conversely, 20 percent provided a definitive no, 12 percent said "Probably no", and 2 percent" were undecided but leaning toward no.

Projected sales tax supporters included: "Definitely yes," (27 percent), "Probably yes" (30 percent), and four percent undecided or leaning toward yes. Conversely, 20 percent provided a definitive no, 12 percent said "Probably no", and 2 percent" were undecided but leaning toward no.

In comparison, the figures showing residents' opinions regarding potential bond and parcel tax measures are shown in the chart accompanying this article.

In comparison, the figures showing residents' opinions regarding potential bond and parcel tax measures are shown in the chart accompanying this article.

FM3 concluded, "Of the three measures, the sales tax generated the most support."

FM3 concluded, "Of the three measures, the sales tax generated the most support."

Reasons cited by those opposed included "No more taxes" (39 percent) and general government mistrust (34 percent).

Reasons cited by those opposed included "No more taxes" (39 percent) and general government mistrust (34 percent).

Public Forum and Council Discussion

Public Forum and Council Discussion

Richard Colman, one of four Orindans at the meeting urging the Council to reject a sales tax increase, noted that California already has the highest sales tax in the nation. If proposals by the City and California's Governor both take effect, Orinda's tax would be pushed from 8.25 to 9.25 percent.

Richard Colman, one of four Orindans at the meeting urging the Council to reject a sales tax increase, noted that California already has the highest sales tax in the nation. If proposals by the City and California's Governor both take effect, Orinda's tax would be pushed from 8.25 to 9.25 percent.

"The sales tax," said Colman, "hurts senior citizens on modest, fixed incomes."

"The sales tax," said Colman, "hurts senior citizens on modest, fixed incomes."

Others questioned the poll's cost and asked for clarification regarding the amount of revenue that might be generated.

Others questioned the poll's cost and asked for clarification regarding the amount of revenue that might be generated.

As one of two residents in support, former Orinda Mayor Bill Judge described road repair as "unfinished business."

As one of two residents in support, former Orinda Mayor Bill Judge described road repair as "unfinished business."

Council Member Severson asked Metz to clarify FM3's margin of sample error (plus or minus 4.9 percent), and was told this is "just the random chance effect" - different individuals might vote, support for the measure might change.

Council Member Severson asked Metz to clarify FM3's margin of sample error (plus or minus 4.9 percent), and was told this is "just the random chance effect" - different individuals might vote, support for the measure might change.

City Manager Janet Keeter advised the Council that if it wishes to raise Orinda's sales tax, it would need to bring the issue before voters in November rather than June 2012 because, by law, the City may only place general use sales tax measures on ballots of regularly scheduled general elections - unless it can show that it has a genuine financial emergency.

City Manager Janet Keeter advised the Council that if it wishes to raise Orinda's sales tax, it would need to bring the issue before voters in November rather than June 2012 because, by law, the City may only place general use sales tax measures on ballots of regularly scheduled general elections - unless it can show that it has a genuine financial emergency.

In response to the Council's concerns about having both a City and State sales tax measure on the same ballot, Metz advised that, in FM3's experience, when local and state tax measures are scheduled during the same election, local measures generally still pass.

In response to the Council's concerns about having both a City and State sales tax measure on the same ballot, Metz advised that, in FM3's experience, when local and state tax measures are scheduled during the same election, local measures generally still pass.

If approved, Orinda's sales tax would take effect January 1, 2013; however, said staff, the mechanism for the State to begin collecting new taxes would likely not be in place until April 1 with revenues not reaching City coffers until September.

If approved, Orinda's sales tax would take effect January 1, 2013; however, said staff, the mechanism for the State to begin collecting new taxes would likely not be in place until April 1 with revenues not reaching City coffers until September.

Council Member Victoria Smith observed that it will be important for the Council to clearly explain its decision to residents: "Here's the plan. We're spending the money on roads."

Council Member Victoria Smith observed that it will be important for the Council to clearly explain its decision to residents: "Here's the plan. We're spending the money on roads."

The Council will continue its deliberations on February 21.

The Council will continue its deliberations on February 21.

|

| | | | | | | | | | | | Advertisement | | |

| | | print story

Before you print this article, please remember that it will remain in our archive for you to visit anytime.

download pdf

(use the pdf document for best printing results!) | | | Comments | | |

| | | | | | | | | | | | | | | | |