|

|

Published February 10th, 2016

|

Lynn's Top Five

|

| Investing in Volatile Times |

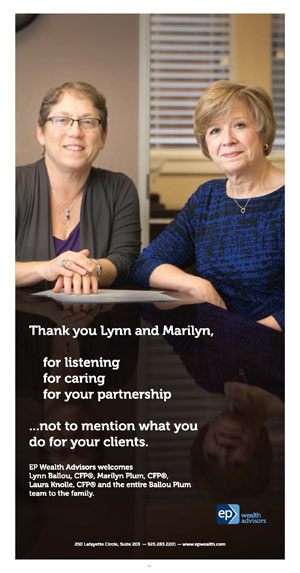

| By Lynn Ballou, CFP(r) |

|

| Lynn Ballou is a CERTIFIED FINANCIAL PLANNER (tm) professional and Regional Director with EP Wealth Advisors, a Registered Investment Advisory Firm in Lafayette. Information used in the writing of this column is believed to be factual and up-to-date, however, we do not guarantee its accuracy. This column does not involve the rendering of personalized investment advice and is not intended to supplement individualized professional advice. A financial, tax and/or legal professional should be consulted before implementing any of the strategies directly or indirectly suggested and discussed. All investment strategies have the potential for profit or loss. |

I have come to believe that market volatility is the new normal. Ever since public access to the Internet connected us in profound and irreversible ways, so too has more information been available to investors than we can perhaps, given our nature, immediately process. This phenomenon can certainly contribute to some sleepless nights. To help you regain some sense of calm and control, here are some ideas for you to consider as you manage your portfolios in these challenging times.

1) Systematic investing: Since we won't know what day investment markets reach their lowest until it's a historical fact, it is helpful to invest specific amounts of money over an appropriate period of time and not all at once. This is also known as dollar cost averaging. If you are contributing to a retirement plan at work, you are engaging in this investment process. If you are reinvesting your dividends and capital gains back into fund holdings, you are also in a small fashion doing the same. This approach can keep you from investing too much all at once when you are not clear where market valuations are headed in the short run, but you want to be invested for the long term.

1) Systematic investing: Since we won't know what day investment markets reach their lowest until it's a historical fact, it is helpful to invest specific amounts of money over an appropriate period of time and not all at once. This is also known as dollar cost averaging. If you are contributing to a retirement plan at work, you are engaging in this investment process. If you are reinvesting your dividends and capital gains back into fund holdings, you are also in a small fashion doing the same. This approach can keep you from investing too much all at once when you are not clear where market valuations are headed in the short run, but you want to be invested for the long term.

2) Portfolio design ideas before retirement: Today you might be a full-time worker, perhaps raising a family, with retirement a distant idea. If you are still working, figure out how much you might need over the next year in the way of cash flow for upcoming projects, a possible job loss, or an extra expense such as college or a car. Keep an amount that's equivalent to that need out of markets that experience volatility, for example the stock market, or are illiquid, for example real estate. Having an appropriate amount of money set aside for short-term needs during volatile times should allow you to still enjoy your life with less worry.

2) Portfolio design ideas before retirement: Today you might be a full-time worker, perhaps raising a family, with retirement a distant idea. If you are still working, figure out how much you might need over the next year in the way of cash flow for upcoming projects, a possible job loss, or an extra expense such as college or a car. Keep an amount that's equivalent to that need out of markets that experience volatility, for example the stock market, or are illiquid, for example real estate. Having an appropriate amount of money set aside for short-term needs during volatile times should allow you to still enjoy your life with less worry.

3) Portfolio design ideas during retirement: If you are about to retire, or have already, you need to think differently. Your assets need to be able to weather down market cycles while still benefiting from growth times. In addition to the idea of setting up reserves for short-term expenses, you also must create a dependable income stream. One approach is to think about the number of years markets can take to recover when they experience difficulties, and build a portfolio that produces enough income to help you through. You want to avoid selling assets when markets are low. You also need to be tactical about what assets you spend and in which order with respect to tax matters. Additionally you might decide to begin pensions or social security payments earlier in order to defer the need to withdraw as much from your investments.

3) Portfolio design ideas during retirement: If you are about to retire, or have already, you need to think differently. Your assets need to be able to weather down market cycles while still benefiting from growth times. In addition to the idea of setting up reserves for short-term expenses, you also must create a dependable income stream. One approach is to think about the number of years markets can take to recover when they experience difficulties, and build a portfolio that produces enough income to help you through. You want to avoid selling assets when markets are low. You also need to be tactical about what assets you spend and in which order with respect to tax matters. Additionally you might decide to begin pensions or social security payments earlier in order to defer the need to withdraw as much from your investments.

4) What's your risk tolerance? Can you handle down markets? If so, in what ways and how much? Some of you love the ride and are okay with volatility. Others would rather avoid portfolio bounce, preferring to experience fewer market pops in return for mitigating the impact of market drops. There are some great online tools for you to use to assess your tolerance for risk. Take them during good times and bad to keep it real. Your trusted advisors can assist you with this as well.

4) What's your risk tolerance? Can you handle down markets? If so, in what ways and how much? Some of you love the ride and are okay with volatility. Others would rather avoid portfolio bounce, preferring to experience fewer market pops in return for mitigating the impact of market drops. There are some great online tools for you to use to assess your tolerance for risk. Take them during good times and bad to keep it real. Your trusted advisors can assist you with this as well.

5) Have an honest look at your personal investment resources. Even the most logical portfolio can only do so much. You need to make sure you don't count on your portfolio to perform unrealistic tasks for you during your life. If you have limited resources, what you can control are spending, increasing savings or maybe even delaying retirement. If you are retired, perhaps there is part-time, enjoyable work you could take up. Volunteer at the theatre to see shows for free. Work as a customer service driver for an auto service shop if you miss people. Work for Uber or Lyft, even! Do whatever you can to take some amount of spending stress off your assets' shoulders.

5) Have an honest look at your personal investment resources. Even the most logical portfolio can only do so much. You need to make sure you don't count on your portfolio to perform unrealistic tasks for you during your life. If you have limited resources, what you can control are spending, increasing savings or maybe even delaying retirement. If you are retired, perhaps there is part-time, enjoyable work you could take up. Volunteer at the theatre to see shows for free. Work as a customer service driver for an auto service shop if you miss people. Work for Uber or Lyft, even! Do whatever you can to take some amount of spending stress off your assets' shoulders.

So what's the bottom line here? You and I cannot control markets, but we can control our investor behavior. Think about your core values and investment needs both short and long-term and don't ignore your risk tolerance factor. A good night's sleep can be an asset, too!

So what's the bottom line here? You and I cannot control markets, but we can control our investor behavior. Think about your core values and investment needs both short and long-term and don't ignore your risk tolerance factor. A good night's sleep can be an asset, too!

|

|

|

|

|

|

|

|

|

| |

|

|

|

|