| | Published February 7th, 2018

| Property fee assessment for storm drains headed toward a special election

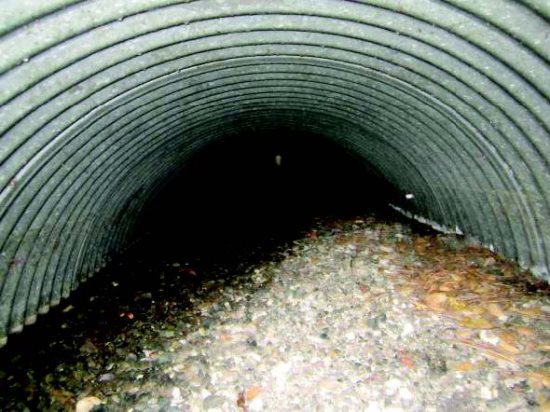

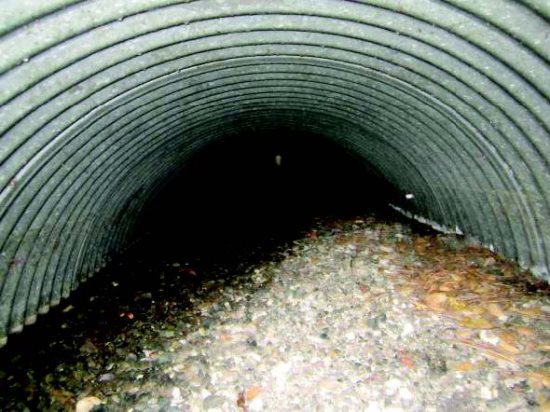

| | | By Nick Marnell |  | | Canyon Road Photos provided |

The Moraga Town Council decided to no longer kick the storm drains down the road.

"It is important that the council speak unanimously on this issue," Mayor Dave Trotter exhorted his council members Jan. 24, and Trotter got his wish. The council unanimously authorized adopting ballot procedures to charge residents for the $26 million the town says it needs to repair its storm drain infrastructure.

"It is important that the council speak unanimously on this issue," Mayor Dave Trotter exhorted his council members Jan. 24, and Trotter got his wish. The council unanimously authorized adopting ballot procedures to charge residents for the $26 million the town says it needs to repair its storm drain infrastructure.

The Moraga Revenue Enhancement Committee alerted town officials in 2009 of the need for revenue for storm drain repair, but when voters passed Measure K in 2012, imposing a 1 percent general purpose sales tax in the town, the council determined that roads were the major need at the time.

The Moraga Revenue Enhancement Committee alerted town officials in 2009 of the need for revenue for storm drain repair, but when voters passed Measure K in 2012, imposing a 1 percent general purpose sales tax in the town, the council determined that roads were the major need at the time.

In response to the committee findings, the town completed a Storm Drain Master Plan in 2015, and residents specifically mentioned storm drain repair as one of the top town priorities in a 2016 community survey. Yet despite higher than expected property tax revenue since 2014, the town set aside no money for storm drain improvements, and the town seeks to place a property fee assessment on the ballot in a May special election, which could cost the town up to $100,000.

In response to the committee findings, the town completed a Storm Drain Master Plan in 2015, and residents specifically mentioned storm drain repair as one of the top town priorities in a 2016 community survey. Yet despite higher than expected property tax revenue since 2014, the town set aside no money for storm drain improvements, and the town seeks to place a property fee assessment on the ballot in a May special election, which could cost the town up to $100,000.

"The time to act is now," said Council Member Kymberleigh Korpus, with residents having just endured the aggravation of a sinkhole for 20 months.

"The time to act is now," said Council Member Kymberleigh Korpus, with residents having just endured the aggravation of a sinkhole for 20 months.

If a majority of ballots cast at the special election approve the initiative, owners of an average-sized single-family residence will be assessed $120 each year, and owners of multi-family residences and commercial property will pay up to $940 per acre annually. Even schools and churches will pay the fee. The measure, projected to bring in nearly $800,000 per year, includes no end date and allows for up to a 3 percent annual inflation increase.

If a majority of ballots cast at the special election approve the initiative, owners of an average-sized single-family residence will be assessed $120 each year, and owners of multi-family residences and commercial property will pay up to $940 per acre annually. Even schools and churches will pay the fee. The measure, projected to bring in nearly $800,000 per year, includes no end date and allows for up to a 3 percent annual inflation increase.

Property owners who object to the fee assessment may plead their case prior to or at a public hearing scheduled for March 14. According to Edric Kwan, public works director, any owner of a parcel of real property subject to the proposed storm drain fee may file a legibly signed protest with the town clerk, identifying the parcel by address or assessor's parcel number. If a majority of parcel owners object to the fee before the hearing, there will be no special election.

Property owners who object to the fee assessment may plead their case prior to or at a public hearing scheduled for March 14. According to Edric Kwan, public works director, any owner of a parcel of real property subject to the proposed storm drain fee may file a legibly signed protest with the town clerk, identifying the parcel by address or assessor's parcel number. If a majority of parcel owners object to the fee before the hearing, there will be no special election.

New homeowners, strapped with higher property taxes than long-time residents, receive no break on the storm drain fee; the only discount goes to parcel owners on private sewer systems. Furthermore, though the proposed fee would be added to owners' property tax bills, the storm drain fee is not tax deductible, Kwan said.

New homeowners, strapped with higher property taxes than long-time residents, receive no break on the storm drain fee; the only discount goes to parcel owners on private sewer systems. Furthermore, though the proposed fee would be added to owners' property tax bills, the storm drain fee is not tax deductible, Kwan said.

Trotter said that early polling supported the storm drain fee, but the mayor was taking no chances. There are limits to what public officials can do to promote their own ballot measures, but Trotter made it clear to the council members that nothing prevents them from independently doing anything they want in the community to support the initiative.

Trotter said that early polling supported the storm drain fee, but the mayor was taking no chances. There are limits to what public officials can do to promote their own ballot measures, but Trotter made it clear to the council members that nothing prevents them from independently doing anything they want in the community to support the initiative.

The town staff will hold public informational meetings on the storm drain fee initiative, with the first ones scheduled for 3:30 p.m. and 6:30 p.m. Feb. 12 at the town chambers.

The town staff will hold public informational meetings on the storm drain fee initiative, with the first ones scheduled for 3:30 p.m. and 6:30 p.m. Feb. 12 at the town chambers.

|

| | St. Mary's Road |  | | Rheem Boulevard and Center Street | | | | | | | | | |