| | Published January 19th, 2022

| The Real Estate Year in Review

| | | By Conrad Bassett, Licensed Real Estate Broker and CRP, GMS-T |  | | |

Last year was another extremely strong year for sellers of residential real estate in Lamorinda. Sales volume was solid with a minimal increase in supply matched by continued strong demand and desirable interest rates; the result was average prices went up in Lafayette, Moraga and Orinda. The ongoing pandemic did not slow the market at all.

Homes stayed on the market for a similar limited time like in 2019 and 2020 and the majority of homes sold at or above their asking price.

Homes stayed on the market for a similar limited time like in 2019 and 2020 and the majority of homes sold at or above their asking price.

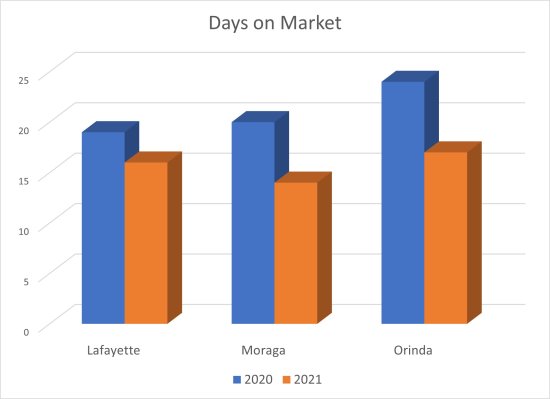

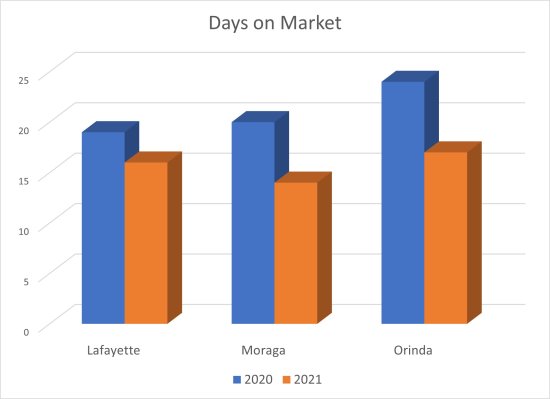

Per Contra Costa Association of Realtors statistics reported for closings Jan. 1 through Dec. 31, 2021, 417 single family homes closed in Lafayette versus 344 in 2020 and 288 in 2019. For the 417 reported closings, sales prices ranged from $840,000 to $11.5 million and the average time on market was 16 days, a decrease from the 19 days in 2020.

Per Contra Costa Association of Realtors statistics reported for closings Jan. 1 through Dec. 31, 2021, 417 single family homes closed in Lafayette versus 344 in 2020 and 288 in 2019. For the 417 reported closings, sales prices ranged from $840,000 to $11.5 million and the average time on market was 16 days, a decrease from the 19 days in 2020.

The average sales price was $2,124,266 - a significant increase from $1,916,042 in 2020 - and from the $1,789,012 in 2019, the $1,736,519 in 2018 and the $1,625,636 in 2017. The average price has doubled in the last decade.

The average sales price was $2,124,266 - a significant increase from $1,916,042 in 2020 - and from the $1,789,012 in 2019, the $1,736,519 in 2018 and the $1,625,636 in 2017. The average price has doubled in the last decade.

The average sales price was 107.5% of the final list price, which in 2021 was $1,975,464. Again, it is only an average, but the average sales price in dollars was just about $150,000 above the average asking price. In 2020 it was 101.7% of the final list price. This comes from a combination of properties being listed well below their actual value and in some cases "bidding wars" that pushed up prices. There were two Lafayette foreclosures sold on the MLS.

The average sales price was 107.5% of the final list price, which in 2021 was $1,975,464. Again, it is only an average, but the average sales price in dollars was just about $150,000 above the average asking price. In 2020 it was 101.7% of the final list price. This comes from a combination of properties being listed well below their actual value and in some cases "bidding wars" that pushed up prices. There were two Lafayette foreclosures sold on the MLS.

Only seven homes closed below $1 million.

Only seven homes closed below $1 million.

In Moraga there were 184 single family closings in 2021, with 175 single family closings in 2020 and 129 single family closings in 2019. Prices ranged from $1.06 million to $3.9 million. The average sales price was $1,926,353. In 2020 it was $1,590,853, $1,486,327 in 2019 and $1,485,713 in 2018. It was $1,388,287 in 2017 and $1,272,179 in 2016. As in Lafayette, the average home price has doubled in the last decade.

In Moraga there were 184 single family closings in 2021, with 175 single family closings in 2020 and 129 single family closings in 2019. Prices ranged from $1.06 million to $3.9 million. The average sales price was $1,926,353. In 2020 it was $1,590,853, $1,486,327 in 2019 and $1,485,713 in 2018. It was $1,388,287 in 2017 and $1,272,179 in 2016. As in Lafayette, the average home price has doubled in the last decade.

The average number of days on market in 2021 was 14. In 2020 it was 20. The average home sold for 109% of its asking price. The average list price was $1,777,012 so the average home sold for about $150,000 above asking. A year ago, it sold for 102% of its last list price. There was one REO property that closed on the MLS and no short sales.

The average number of days on market in 2021 was 14. In 2020 it was 20. The average home sold for 109% of its asking price. The average list price was $1,777,012 so the average home sold for about $150,000 above asking. A year ago, it sold for 102% of its last list price. There was one REO property that closed on the MLS and no short sales.

In Orinda the number of single-family closings was 373 versus 302 a year ago - an increase from the 261 in 2019. The reported sales ranged in price from $925,000 to $8 million with an average price of $2,187,385. In 2020 it was $1,889,942. In 2019 it was $1,629,030 and in 2018 it was $1,729,306. In 2017 it was $1,614,279 and 2016 it was $1,577,727. Again, the average sales price has more than doubled in the last 10 years. The average market time was 17 days - down from 24 days a year ago.

In Orinda the number of single-family closings was 373 versus 302 a year ago - an increase from the 261 in 2019. The reported sales ranged in price from $925,000 to $8 million with an average price of $2,187,385. In 2020 it was $1,889,942. In 2019 it was $1,629,030 and in 2018 it was $1,729,306. In 2017 it was $1,614,279 and 2016 it was $1,577,727. Again, the average sales price has more than doubled in the last 10 years. The average market time was 17 days - down from 24 days a year ago.

The average sales price was an average of 108% of the final list price. A year ago it was 101.7% of the final list price for the reported sales. There were no REO (bank owned) sales in Orinda in 2021.

The average sales price was an average of 108% of the final list price. A year ago it was 101.7% of the final list price for the reported sales. There were no REO (bank owned) sales in Orinda in 2021.

There were three reported sales in Canyon in the MLS in 2021 and the average sales price was $1,082,667.

There were three reported sales in Canyon in the MLS in 2021 and the average sales price was $1,082,667.

On an average price per square foot basis for reported sales in 2021, Lafayette homes sold for $823.60, well above the $703.44 in 2020 and up from 2019 when it was $671.90.

On an average price per square foot basis for reported sales in 2021, Lafayette homes sold for $823.60, well above the $703.44 in 2020 and up from 2019 when it was $671.90.

In 2021, Moraga homes sold for $775.04 per square foot versus $644.18 in 2020. In 2019, Moraga homes sold for $610.00 per square foot.

In 2021, Moraga homes sold for $775.04 per square foot versus $644.18 in 2020. In 2019, Moraga homes sold for $610.00 per square foot.

In Orinda last year homes sold for $797.26 per square foot, versus $672.53 in 2020 and $624.28 per square foot for the average home in 2019.

In Orinda last year homes sold for $797.26 per square foot, versus $672.53 in 2020 and $624.28 per square foot for the average home in 2019.

In the condominium/town home category, Lafayette had 36 closings, up from 31 closings in 2020. Sales prices ranged in 2021 from $628,000 to $1,835,000. Moraga had 118 closed units, up from 71 in 2020. Sales ranged from $350,000 to $1.5 million. This includes "attached" homes in Moraga Country Club. Orinda had 13 closings, up from five in 2020. Eight of these were in the complexes on Brookwood Road and the others in Orindawoods. They sold from $420,000 to $1.495 million.

In the condominium/town home category, Lafayette had 36 closings, up from 31 closings in 2020. Sales prices ranged in 2021 from $628,000 to $1,835,000. Moraga had 118 closed units, up from 71 in 2020. Sales ranged from $350,000 to $1.5 million. This includes "attached" homes in Moraga Country Club. Orinda had 13 closings, up from five in 2020. Eight of these were in the complexes on Brookwood Road and the others in Orindawoods. They sold from $420,000 to $1.495 million.

It should always be noted that there are also a few direct sales that do not go through the MLS and they are not reported here. These are usually sales between private individuals.

It should always be noted that there are also a few direct sales that do not go through the MLS and they are not reported here. These are usually sales between private individuals.

As of Jan. 8, there were only 25 dwellings under contract per the MLS in the three communities combined, with asking prices of $1.049 million to $12.8 million. It should be pointed out that there are no REOs and no short sales. Prices have continued to rise over the last few years and more owners now have equity in their homes and have not had to go the short-sale process or face foreclosure.

As of Jan. 8, there were only 25 dwellings under contract per the MLS in the three communities combined, with asking prices of $1.049 million to $12.8 million. It should be pointed out that there are no REOs and no short sales. Prices have continued to rise over the last few years and more owners now have equity in their homes and have not had to go the short-sale process or face foreclosure.

A comparison of year-end inventory in the three communities combined shows 18 homes on the market. Last January there were 49 homes on the market. Seasonally the biggest inventory is in the spring and early summer, however this current number may point to another year with a combination of qualified buyers vying for a continued limited supply. The current asking prices range from $1 million to $6.5 million in the three communities combined.

A comparison of year-end inventory in the three communities combined shows 18 homes on the market. Last January there were 49 homes on the market. Seasonally the biggest inventory is in the spring and early summer, however this current number may point to another year with a combination of qualified buyers vying for a continued limited supply. The current asking prices range from $1 million to $6.5 million in the three communities combined.

In Lamorinda in 2020, 55 homes sold for over $3 million! In Lafayette alone 56 sold for $3 million or more in 2021.

In Lamorinda in 2020, 55 homes sold for over $3 million! In Lafayette alone 56 sold for $3 million or more in 2021.

Mortgage rates have remained historically low. Corporate relocations have slowed down due to their employees being able to continue to work remotely. Many of these relocations will likely come to pass once offices more fully reopen. We have not seen many outbound relocations for people working for companies who have announced that their corporate headquarters will be moving out of the state.

Mortgage rates have remained historically low. Corporate relocations have slowed down due to their employees being able to continue to work remotely. Many of these relocations will likely come to pass once offices more fully reopen. We have not seen many outbound relocations for people working for companies who have announced that their corporate headquarters will be moving out of the state.

The minimal amount of single-family new construction has helped keep supply and demand within a better balance than a lot of other neighboring communities.

The minimal amount of single-family new construction has helped keep supply and demand within a better balance than a lot of other neighboring communities.

The East Bay communities like Lafayette, Moraga, and Orinda as well as Piedmont and several neighborhoods in Oakland and Berkeley continue to benefit from their proximity to San Francisco where prices remain very high. Comparably speaking, the East Bay is still relatively more affordable.

The East Bay communities like Lafayette, Moraga, and Orinda as well as Piedmont and several neighborhoods in Oakland and Berkeley continue to benefit from their proximity to San Francisco where prices remain very high. Comparably speaking, the East Bay is still relatively more affordable.

The trend that began in 2011 continues today where in many situations in the three communities, the seller receives multiple offers and homes sell for above the list price. This, when coupled with a relatively low supply and a willingness by sellers to be realistic in their pricing should continue to fuel a strong market in 2022.

The trend that began in 2011 continues today where in many situations in the three communities, the seller receives multiple offers and homes sell for above the list price. This, when coupled with a relatively low supply and a willingness by sellers to be realistic in their pricing should continue to fuel a strong market in 2022. |

| | | | | | | | | | | | |